Ukrainian businesses gave their most cautious assessment in months as industrial companies prepare to reduce both production and workforce. At the same time, retail trade continues to thrive on consumer demand, according to the National Bank of Ukraine’s (NBU) November survey, published on 1 December.

Ukraine’s economic reality heading into 2026: ordinary Ukrainians are still spending, keeping shops busy for nine consecutive months, but Russian strikes on power infrastructure are eroding the country’s productive base, driving up costs, and depleting the workforce through mobilization and emigration.

At the same time, Western allies counting on Ukrainian industrial capacity for defense production are watching that capacity shrink under sustained attack.

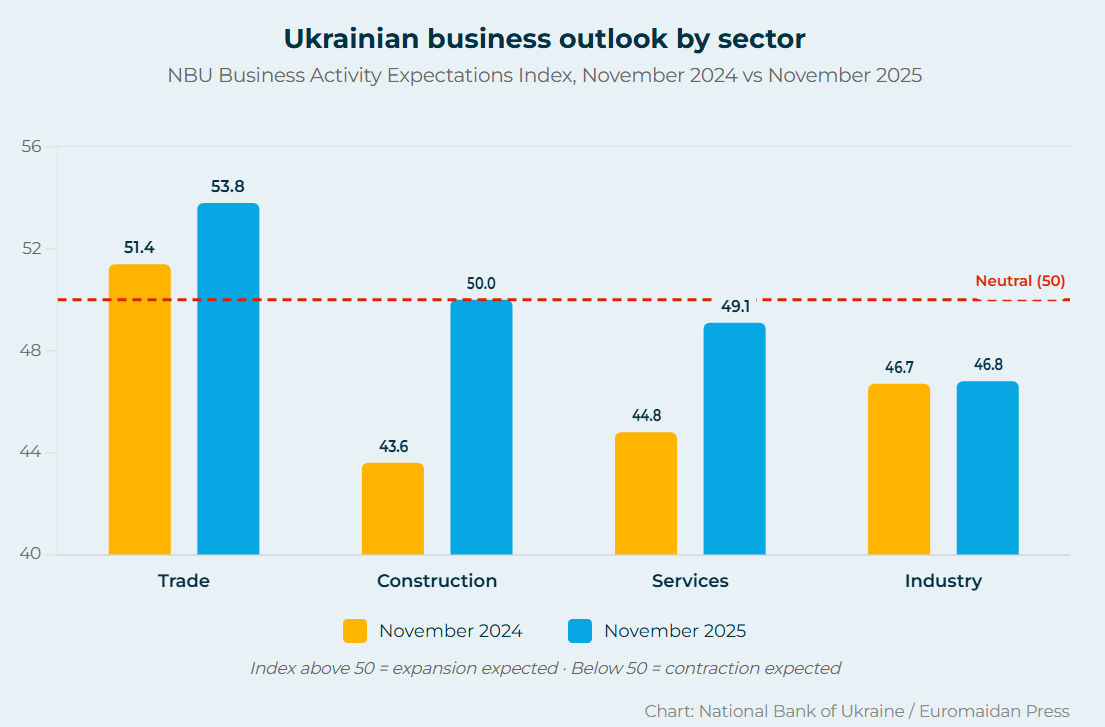

The NBU’s business activity expectations index measures company outlooks on a scale where 50 is neutral; above 50 signals expansion expectations, and below 50 signals contraction. The composite index fell to 49.4 in November from 50.3 in October, crossing into pessimistic territory for the first time since the summer.

Trade thrives on consumer demand

Retail companies recorded their ninth straight month of positive expectations, with a sectoral index of 53.8—the highest among all sectors surveyed. The NBU attributed the optimism to strong consumer demand, steadily declining inflation, and a diverse range of product availability.

Trading companies expect to increase both sales volumes and inventory purchases in the coming months, though they anticipate narrower profit margins.

The healthy consumer activity aligns with Ukraine’s broader fiscal picture. Through October, the government collected $1.3 billion more in revenue than budgeted, with import VAT—driven by consumer purchases of foreign goods—accounting for $10.7 billion, the largest single revenue source.

Industry expects production cuts

Industrial companies delivered the gloomiest assessment, with their index falling to 46.8 from 48.8 in October. For the first time, manufacturers expect to reduce output rather than maintain or expand it.

The NBU cited intensified Russian attacks destroying production facilities, persistent electricity shortages, rising costs for raw materials and fuel, and a shortage of qualified workers.

The worker deficit reflects a nationwide crisis.

Trending Now

A Radio Free Europe/Radio Liberty (RFE/RL) investigation published on 1 December found that 6-7 million Ukrainians have left the country since the full-scale invasion began. At the same time, conscription continues draining the civilian workforce. The State Employment Center identified the sharpest shortages in education, transportation, metal product manufacturing, furniture production, and energy supply—sectors that heavily overlap with industrial production.

“The shortage of people with technical skills and education is catastrophic,” Ukrainian economist Oleh Penzin told RFE/RL.

Russian attacks on energy infrastructure continued overnight. On 2 December, Shahed drones struck Odesa Oblast, damaging an energy facility and causing power outages—the latest in a systematic campaign targeting Ukraine’s electricity supply as winter has begun.

Construction holds steady, services lag

Construction companies held steady at 50.0, supported by government spending on road construction and infrastructure restoration. The sector anticipates continued demand for building materials and subcontractor services, although seasonal factors will reduce the number of new contracts.

Services companies improved slightly to 49.1 from 48.7, but remain below the neutral threshold. The sector cited worsening security conditions, power disruptions, and logistical complications as constraints.

Both construction and services expect to reduce staff in the coming months, with industrial companies planning the deepest cuts.

Resilience despite escalation

“The war is grinding on,” NBU Governor Andriy Pyshnyy said at a 27 November workshop. “Although we are restoring elements of normality, a full return is still ahead.” Despite the monthly decline, the composite index of 49.4 remains higher than in November 2024, when it stood at 47.2.

Construction showed the most dramatic improvement, jumping from 43.6 a year ago to 50.0 now. The year-over-year gains suggest Ukrainian businesses have adapted to wartime conditions—even as Russia’s attacks intensify, the economic floor has risen compared to last winter’s crisis.

The NBU surveyed 592 companies between 4 and 21 November, with 43.6% from industry, 25.3% from trade, 25% from services, and 6.1% from construction.