Today, the biggest news comes from the Russian Federation.

Here, Russia is facing a rapidly worsening shortage of currency as falling oil revenues and severe pressure on its export system cut deeply into its reserves.

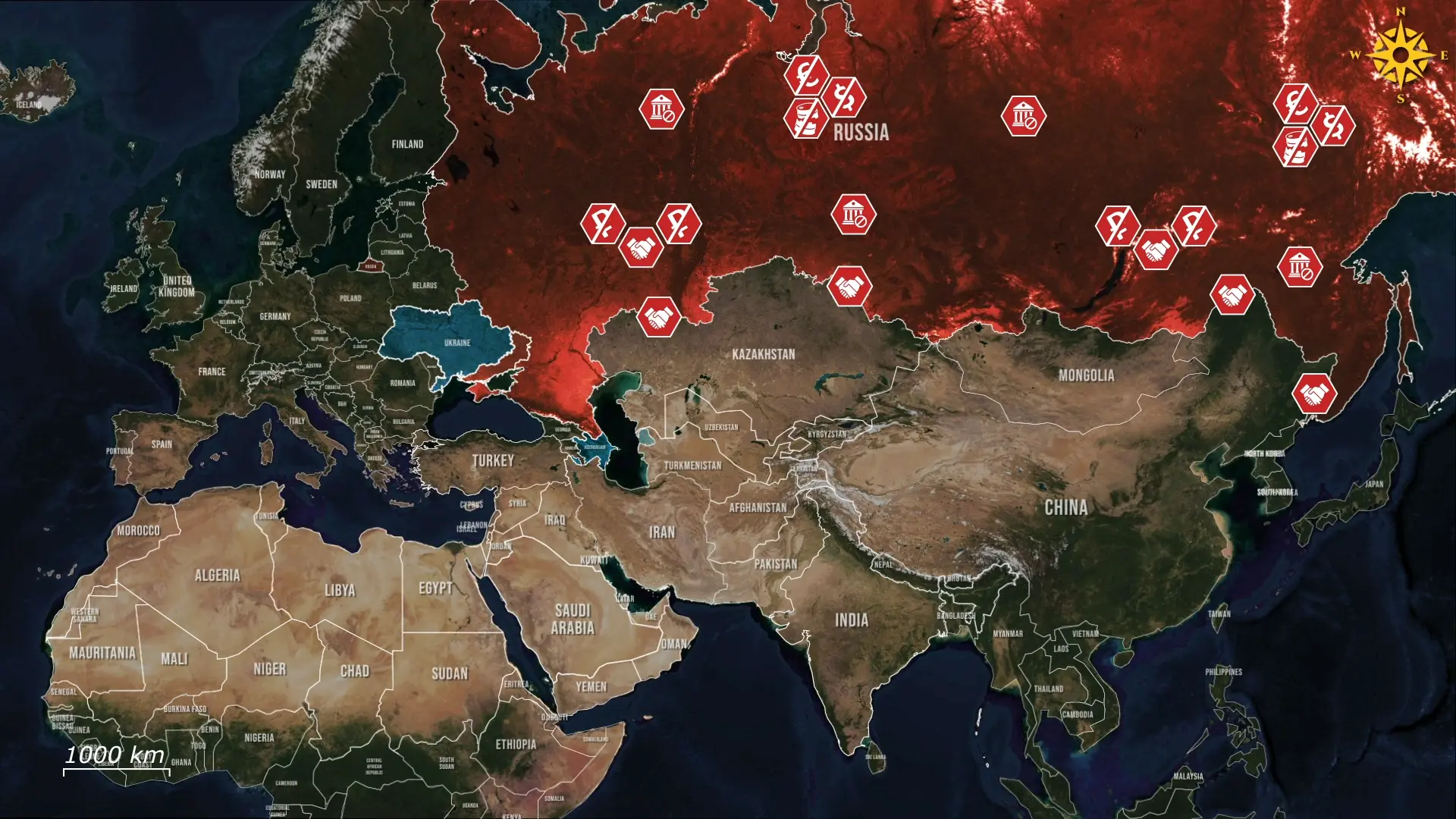

In response, Moscow is reintroducing foreign-trade barter, reviving stone age economic practices and tactics from the post-soviet economic collapse in a desperate effort to keep imports flowing in.

Russia reintroduces barter trade amid currency crisis

In recent weeks, major international outlets, including Reuters, El País, and the Kyiv Independent, have confirmed that Russia has reintroduced barter for international trade.

The reported deals involve swapping commodities such as wheat and flax for Chinese cars, construction materials, and home appliances, with at least eight transactions documented so far.

Economy Ministry issues formal guide for goods-for-goods contracts

These arrangements are detailed and formal rather than improvised. They are supported by a 14-page guide issued by the Russian Economy Ministry that instructs companies on how to structure goods-for-goods contracts, bypass banking channels, and settle value through physical shipments instead of money.

Collapsing oil exports trigger hard currency shortage

The reason Russia is doing this now lies in the oil-money crisis reshaping the country's economic landscape, because falling oil revenues directly translate into a shortage of the hard currencies that Russia depends on to pay for imports.

Over the past several months, seaborne crude shipments through key ports such as Primorsk and Ust-Luga have fallen sharply, with Primorsk dropping from its usual nine to ten tankers per week to just three, and Ust-Luga falling from about twelve to thirteen tankers to seven or eight.

US restrictions on Russia's shadow fleet have reduced the number of available tankers and further constrained export capacity. Urals crude is also trading at steep discounts of more than twenty dollars below Brent, widening Russia's revenue gap even further.

Oil revenues down 35% as global prices slide

With global oil prices sliding to around sixty-three dollars per barrel for Brent and roughly fifty-eight dollars for WTI as markets price in the possibility of a Ukraine ceasefire, Russia's net earnings per barrel have fallen even further.

This decline, combined with lower export volumes and wider Urals discounts, has left the government with oil and gas revenues down about thirty-five percent year-on-year in November and more than twenty percent lower over the first eleven months of the year.

Never miss a story.Follow Euromaidan Press on Google News! Value this reporting? Support our work.

BECOME OUR PATRON!

Banking restrictions and sanctions block conventional payments

As these revenues fall, banks inside and outside Russia grow more hesitant to process Russian-linked payments, and many foreign partners refuse to accept rubles because of currency-convertibility limits and the risk that holding Russian assets could expose them to sanctions or future financial scrutiny.

Trending Now

This combination of weak oil income and limited access to global financial infrastructure creates a situation in which Russia struggles to pay for imports even when it wants to, because the currencies it needs are scarcer, harder to transfer, and more heavily scrutinized.

Cross-border monetary payments are increasingly routed through channels that involve higher compliance risk for foreign banks, and swift restrictions, partially frozen reserves, and growing caution among Asian banks make it difficult to move large sums without delay or danger.

Barter offers workaround but exposes Russia to exploitation

Under these conditions, barter becomes the simplest practical alternative, because trading commodities directly for cars, machinery or industrial supplies avoids the monetary flows that sanctions target and relies on assets Russia still controls.

Barter also helps Russia preserve trade relationships it would likely lose under normal payment conditions, because partners can accept commodities without handling rubles or navigating high-risk currency transfers.

By relying on goods-for-goods exchanges as a last resort, Russian firms can keep critical imports moving even as the financial system around them becomes too constrained for conventional transactions to function.

Shift reflects Russia's growing isolation from global finance

Overall, Russia's return to barter is best seen as a response to a tightening squeeze on its core source of hard-currency income rather than an innovative form of economic resilience.

As oil revenues fall and usable dollars and euros become harder to obtain, the country is being pushed to settle trade through commodities instead of cash, even though barter is slower, less efficient, and leaves Russia more exposed to stronger partners.

This shift reflects a broader withdrawal from the global financial system and a turn toward abstract, low-productivity exchanges that raise costs and weaken its negotiating position.

If present trends continue, Russia's foreign trade will become more dependent on barter and other low-visibility mechanisms, forcing it to rely on transactions that are harder to price, more open to exploitation, and fundamentally less effective than the monetary systems used in normal international commerce.

In our regular frontline report, we pair up with the military blogger Reporting from Ukraine to keep you informed about what is happening on the battlefield in the Russo-Ukrainian war.

Follow Euromaidan Press on Google News! Value this reporting? Support our work.

BECOME OUR PATRON!