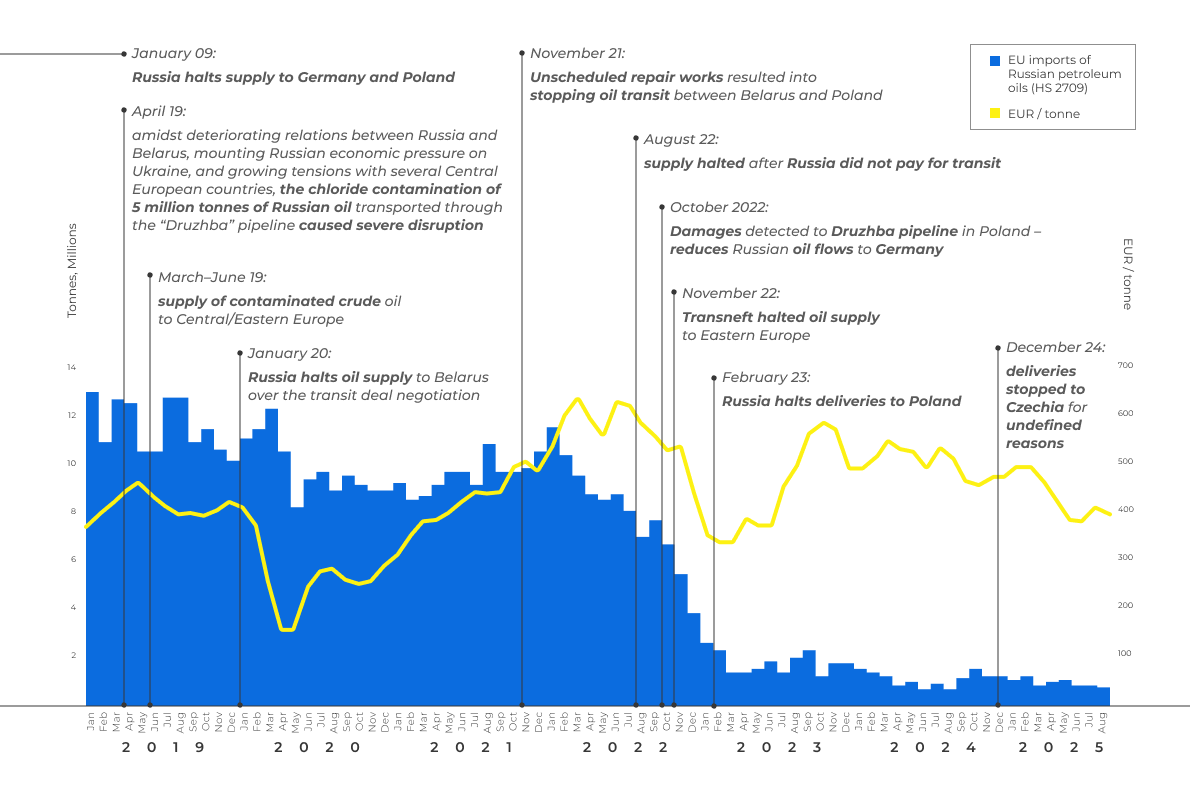

Europe’s progress in cutting Russian energy has a hole in it. Pipeline gas imports dropped from 45% to 18% since the invasion—but Russian LNG imports rose 7% in the first half of 2025, hitting record levels. The back door stayed open while the front door closed.

France now takes 41% of Europe’s Russian LNG, followed by Belgium (28%) and Spain (20%). Since February 2022, EU countries paid €216 billion for Russian fossil fuels overall—including €36 billion for LNG alone. In 2024, Europe paid more to Russia for energy than it gave Ukraine in aid.

These aren’t market forces. This business is maintained by an extensive influence network, which a new investigation from the Ukrainian NGO Razom We Stand maps in unprecedented detail.

Shocking scale

Former German Chancellor Gerhard Schröder joined Gazprom’s board. Austria’s former Foreign Minister, Karin Kneissl, runs a Russian think tank in St. Petersburg. France’s former Prime Minister François Fillon took a seat at state-owned Zarubezhneft. All of these are strategic placements in an influence network designed to keep European money flowing to Moscow.

The scale of that flow: €216 billion since February 2022, according to a new report from Ukrainian NGO Razom We Stand. That includes €36 billion for liquefied natural gas alone—revenue funding the missiles striking Ukrainian cities while European leaders pledge support for Kyiv.

“Even with awareness of Russia’s propaganda investments, it was shocking to see the scale of political capture,” says Iryna Ptashnyk, Research and Policy Advisor at Razom We Stand.

“Senior politicians in Europe’s most powerful countries actively advanced Kremlin interests—not just before the invasion, but after sanctions were imposed.”

Before this report, European policymakers could deflect questions about Russian influence with vague acknowledgments. Now they can't. The investigation names names, traces money, and identifies four pressure points where Europe could cut Russian revenue.

The last pillars of Russia’s energy leverage

After Nord Stream’s collapse and the shutdown of Ukrainian transit in January 2025, Russia has only two functioning routes into Europe’s energy market. TurkStream still delivers gas through Türkiye into southern Europe. And the LNG terminals in France and Belgium—Zeebrugge and Dunkirk—handle nearly all the rest, regasifying Russian cargoes that become untraceable once they enter Europe’s network.

ISW: Ukraine’s gas transit halt to cost Gazprom $6 billion as Turkstream becomes only route to EU

Few in number but rich in revenue, these routes are the lifelines Moscow fears Europe could finally cut.

- TurkStream’s regulatory threat. EU negotiators are advancing regulations to halt Russian gas flows through one of Moscow’s last viable export routes. The pipeline represents Russia’s primary access to southern European markets. Türkiye claims it won’t comply with any EU ban, but Ankara’s position depends on maintaining relations with both Moscow and Brussels. The leverage exists—closure would cut revenue while eliminating market access.

- Romania’s Black Sea breakthrough. The Neptun Deep offshore field comes online in 2027 with a capacity of 8 billion cubic meters annually. If Romania integrates into the EU’s energy networks, it could supply Moldova, Bulgaria, and Serbia—markets that Russia currently dominates. Moscow understands the threat: disinformation campaigns push narratives that “Black Sea gas benefits only foreign corporations” and warn that domestic production threatens Romanian sovereignty.

- EastMed pipeline potential. The proposed Eastern Mediterranean pipeline, connecting Israel, Cyprus, Greece, and Italy, could deliver 10-20 billion cubic meters of gas annually, displacing $3-8 billion in Russian exports. Technically complex and years from completion, the project represents exactly what Moscow fears: permanent infrastructure bypassing Russia.

- Türkiye’s accelerating pivot. Russia’s share of Turkish gas imports dropped from over 60% to 37% as of mid-2025. The Trans-Anatolian Pipeline has an annual capacity of 16 billion cubic meters, delivering Azerbaijani gas. Türkiye’s LNG regasification capacity exceeds 45 billion cubic meters yearly. A Turkish break would cost Moscow one of its two largest customers—and threatens something even more valuable: the Akkuyu nuclear power plant.

Akkuyu represents Russia’s largest nuclear construction project globally—a four-reactor complex built and financed entirely by Moscow’s Rosatom at a cost exceeding $20 billion. It’s not just an energy asset; it’s strategic infrastructure giving Russia a long-term presence in Türkiye’s power grid.

If Ankara completes its energy pivot away from Russian gas, the political conditions supporting Akkuyu can collapse. Türkiye could nationalize the facility or cancel the project, leaving Moscow with massive financial losses, protracted legal battles, and the loss of its nuclear export flagship in a NATO country.

How companies keep vulnerabilities open

European companies maintain Russian revenue streams through binding contracts—while lobbying to preserve them.

France’s TotalEnergies holds a 20% stake in Yamal LNG, with contracts for 5 million tonnes annually, contributing an estimated $2.5 billion to the Russian government’s tax income since the invasion. Germany’s SEFE operates under contracts extending to 2038, having paid roughly $1.45 billion. Spain’s Naturgy maintains agreements running until 2041.

Naturgy CEO Francisco Reynés sent two letters to European Commission President Ursula von der Leyen in summer 2025, arguing that abandoning Russian energy would “only make Putin stronger”—corporate lobbying that echoes Kremlin propaganda.

Belgium’s Fluxys earned an estimated €10.7 billion processing Russian LNG through Zeebrugge and Dunkirk terminals since February 2022. Under the company’s 2015 contract with Yamal LNG, Russia pays Fluxys €1 billion over 20 years for terminal access—even if no cargoes arrive. It’s locked-in revenue, incentivizing continued Russian business.

How Moscow evades the cap

The infrastructure enabling these flows depends on Russia’s “shadow fleet”—over 300 aging tankers transporting oil and LNG outside Western insurance and oversight. Through ship-to-ship transfers in international waters, shell company ownership, and false documentation, these tankers generated roughly €22 billion in above-sanctions-cap revenues between December 2022 and September 2025.

Malta’s flag-of-convenience registry provides crucial cover, operating over 10,000 vessels that offer EU legitimacy while maintaining only light oversight. Many vessels connected to the shadow fleet fly Maltese flags, enabling sanctioned trade to continue with European registration.

Once Russian LNG arrives at terminals like Zeebrugge, it gets regasified and injected into Europe’s interconnected pipeline network, where origin becomes untraceable.

Western companies process cargo, earn fees, and maintain that they’re fulfilling existing contracts. Belgian municipalities benefit financially through Fluxys’ ownership stakes. The revenue flows both ways.

Trending Now

China provides another evasion route. Shipments from Russia’s sanctioned Arctic LNG 2 project have been arriving at China’s Beihai terminal since August 2025—the first foreign port to accept these cargoes. Beijing designated Beihai as the sole entry point, anticipating Western retaliation while protecting its broader gas sector.

If European corporate lobbying successfully shields Moscow from accountability, Beijing, Tehran, and Caracas are taking notes. The mechanisms protecting Russian revenue become blueprints for every authoritarian energy exporter.

The influence network that built dependency

Europe’s vulnerability traces to decisions made decades ago. The first Soviet gas pipelines to Western Europe opened in the 1970s and expanded through the 1990s and 2000s as European leaders prioritized cheap energy over strategic independence.

The revolving door between politics and Russian energy reinforced dependency. Schröder approved Nord Stream 1 as Chancellor and then joined Gazprom’s supervisory board immediately after leaving office in 2005, later adding positions at Rosneft. Kneissl served on Rosneft’s board before relocating to Russia in 2023. Fillon joined Zarubezhneft shortly after his term as Prime Minister ended.

Think tanks provided intellectual cover. The German-Russian Forum promoted Nord Stream while opposing diversification. The Dialogue of Civilisations Research Institute, founded by Vladimir Yakunin, a former head of Russian Railways and a close associate of Putin, championed “dialogue” while advancing Russian pipeline projects. These organizations normalized the “gas as bridge fuel” narrative that made sanctioning Russian energy difficult.

The influence networks adapted after 2022 rather than disappearing.

“Russia’s influence networks moved deeper into think tanks, public institutions, and policymaking spaces where narratives about ‘energy security’ are shaped,” warns Ptashnyk. “Russia will do everything possible to ensure certain countries continue implementing energy projects beneficial to it, maintaining and increasing dependence on Russian gas—the Kremlin’s most effective tool of power.”

What happens if Europe acts—or doesn’t

The leverage against Russian influence exists—if Europe acts. EU regulations under negotiation would ban new Russian gas contracts from January 2026, with existing contracts phasing out by January 2027 or 2028, depending on final Parliamentary approval. Expanded sanctions could close loopholes. Enhanced cooperation with Ukrainian intelligence and European civil society could expose influence networks before they have a chance to adapt further.

But the window closes as Russia adjusts. Every month Europe delays means continued revenue funding missiles striking Ukrainian homes.

The same patterns operate worldwide. Russia reoriented exports toward China and India after Western sanctions, with Chinese LNG imports from Russia rising. Asian purchases displaced Middle Eastern supplies, which then backfilled European markets—effectively laundering Russian gas through redirected global flows.

The same shadow fleet evading European sanctions operates across Asian waters. The same corporate lobbying that protects European contracts also appears in energy deals worldwide.

Washington faces the same patterns.

NATO’s eastern flank relies on Romanian energy independence, which will be determined by the success or failure of the Neptun Deep project. Türkiye’s strategic orientation hinges partly on energy diversification—Ankara’s willingness to challenge Moscow correlates with alternatives to Russian gas.

Chinese sanctions evasion through coordinated energy arrangements reveals the depth of Moscow-Beijing coordination, which affects broader strategic competition.

The Razom We Stand report maps where European dependence could be broken. Political capture by former officials protects those dependencies. The question facing policymakers in Brussels, Washington, and elsewhere is: will they act while the opportunity exists, or wait until Russia’s influence networks make action politically impossible?