Ukraine has not fallen into the Chinese orbit, with EU trade 2.5 times exceeding trade with China. Still, over the past 20 years, China has substantially expanded trade with Ukraine, acquired significant assets in energy and agriculture sectors, and attempted to get stakes in aircraft engine construction. The most recent examples include:

- the appropriation attempt of Motor Sich — leading aircraft engines factory;

- expansion of Chinese state-owned agricultural supplier COFCO in Ukraine, which exports 100% of its products to China;

- development of complex infrastructural projects facilitating trade with China such as new cargo trains running weekly from Ukraine to Wuhan and Guangzhou since 2020 and the dredging of the Pivdennyi port in Odesa for Chinese needs;

- expanding Chinese renewable power plans in Ukraine, within the global strategy of controlling and benefiting from renewables (China makes for 42% of global exports of equipment for renewables).

China is widely known for the use of “corrosive capital,” i.e. investments which enter the market but don’t appear to have any purely market justification. Rather, they pursue non-market goals, such as appropriation of technologies, securing access to resources or even attaining some political influence.

Although Ukraine’s Security and Defence Council (RNBO) applied some sanctions to prevent Motor Sich's accession to China in 2021, the question remains whether this is enough and to what extent Chinese investments should be welcomed.

Ukrainian think tank Centre for Economic Strategy (CES) has analyzed the scope of Chinese economic footprint in Ukraine and threats related to Chinese corrosive capital in a 58-pages extensive report. We publish several key findings below.

Trade with China stably on the rise, Ukraine’s totally dependent on China in some items

China is the largest single-nation trading partner of Ukraine, followed by Russia, Poland and Germany. Although Ukraine’s total trade with all EU members is 2.5 times higher than with China, the China-Ukraine turnover increased sharply from 2% of the Ukrainian GDP in 2001 to 11% in 2020.

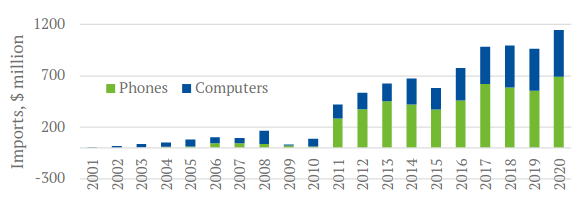

Both Ukraine’s imports from China and exports to China have been rapidly increasing since 2009. However, imports from China significantly outnumber exports. Also, Ukraine exports primarily raw materials and imports mainly processed goods, including hi-tech equipment.

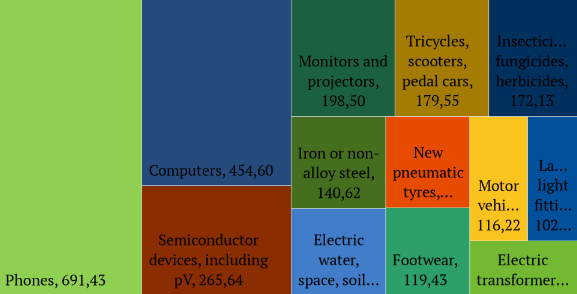

The largest Ukrainian imports from China are phones and computers, along with footwear and other manufactured goods. Chinese companies dominate the retail technology market in Ukraine and large Chinese electronics producers such as Huawei and Lenovo continue to be the most popular choices of the Ukrainians due to their relatively low prices. Chinese companies also conducted telecommunications equipment upgrade for all three leading Ukrainian mobile operators.

For some of the articles, China is almost the monopolist in Ukraine’s imports. This occurs mostly for consumer goods such as textiles and footwear, bicycles, and kitchenware.

China has been the third-largest investor in the world since 2018. Acquiring assets worldwide, primarily resource-related, seems to be a way to secure resource access to develop the Chinese economy further. At the same time, Chinese FDI to Ukraine (including from Hong Kong) is relatively small and barely exceeds 0.3% of the total FDI stock in Ukraine.

Incorporating Singapore, a common offshore jurisdiction for foreign investment, as Chinese stock would result in only 1% of the total FDI stock (compared to 1.7% from the US or Poland, 2% from Russia, 2.3% from France, and 4.5% from Germany or UK).

Acquiring military technologies

China is the second-largest military spender in the world, yielding only to the United States. Chinese hunting for military technologies in Ukraine started already in the 1990s.

Purchase of old aircraft carriers “to make floating hotels” in the 1990s

China used to buy some USSR-made outdated aircraft carriers. Chinese engineers studied the ships carefully and then made floating hotels and theme parks of them. In 1998, Ukraine sold its unfinished carrier Varyag built at the Mykolaiv shipyard for $23 million to a Chinese company, allegedly also to be turned to a floating hotel and theme park.

However, creating a l tourist attraction was not the real aim of the purchase. China started to install new hardware, including weapons on the carrier. In 2011, General Chen Bingde confirmed that China would use it for study purposes and as a model to build their own carriers.

Also, Wuhan Naval Research Institute made a full-scale model for study purposes, also modeled after Varyag. In 2012, the vessel was renamed Liaoning, the first fleet carrier of the People's Liberation Army Navy. In 2014, the first tests were completed. In 2016, the first test shooting was performed and in 2019, China completed the construction of its own carrier Shandong, based on Varyag.

Using Ukrainian aircraft as models for Chinese ones in 2000s

China has a huge ambition in the air and space industry. Local demand for civil aircraft is massive. According to Boeing’s estimate in 2014, China may purchase over 6 thousand units before 2033. Military aircraft are in high demand too.

In 2000s, Ukrainian state company Antonov Aviation Scientific and Technical Complex helped Chinese engineers to construct two first models of Chinese passenger jets based on Antonov AN-140 and AN-12 designs.

Motor Sich

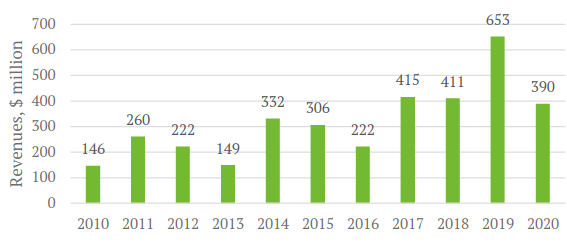

The only major hi-tech article of Ukraine exports to China are turbojets, mainly produced by Motor Sich. So, it is not a coincidence that China tried to purchase this company. Jet engines have been a significant flaw in China's aviation industry. To address this problem, China purchased both Ukrainian and Russian jet engines for its aircraft after unsuccessful attempts to produce replicas of the engines on site.

Motor Sich is the largest manufacturer of aircraft engines in the former Soviet Union market. It supplies products to 106 countries globally but recently, most of its exports were to China. In 2016, China concluded a deal for the supply of 250 training jet engines, worth $380 million with Motor Sich.

In September 2017 Security Service of Ukraine started its investigation on the sale of 41.00087% of the shares of Motor Sich owned by five offshore companies to the Chinese Beijing Skyrizon Aviation Industry Investment Co., Ltd.

In December 2020, the Chinese shareholders of Motor Sich initiated a $3.6 billion arbitration against Ukraine. They claimed that the Ukrainian authorities expropriated their investments, as well as violated other rights

On 14 January, 2021, the United States added Skyrizon to the US Department of Commerce's sanctions list of end-users of military goods. Washington believes that Skyrizon's attempts to acquire foreign military technology threaten US national security.

On 28 January, Ukraine also imposed personal sanctions against Chinese investor in Motor Sich Wang Jing and several related companies. Additionally, on 30 January 2021, President Zelenskyy signed a decree extending sanctions to two other Skyrizon representatives, Du Tao and Chen Hoisheng.

On 20 March 2021, the Shevchenko District Court of Kyiv seized the property complex and 100% of shares of Motor Sich and transferred the property to the National Agency of Ukraine for identification and management of the assets received from corruption and other crimes (ARMA) for their subsequent transfer to the state administrator.

China effectively uses Ukraine for food security. One Chinese company COFCO contolls 50+% of corn exports from Ukraine to China

COFCO holds a substantial stock in Ukrainian agriculture and is the world's largest Chinese agricultural trader, managed directly by the Chinese government. The company has offices in more than 140 countries. It is responsible for half of all Ukrainian export corn to China. The corporation is one of the largest employers in Ukrainian agriculture and one of the largest investors in Ukrainian agricultural infrastructure.

Since 2008, the company has invested more than $200 million, currently owning oil refinery in Mariupol, the grain terminal at Mykolayiv port, and eight elevators across the country, along with other facilities.

Renewables, The Belt and Road initiative, and state procurement as other examples

China is the largest producer and exporter of equipment for electric power plants based on renewable energy sources, with the global export share of 42% in 2019.

It actively promotes green energy globally and benefits from stimulating regulation such as green tariffs. Renewable energy has become the sector with the highest proportion of Chinese capital in Ukraine. Only CNBM, State-owned China National Building Material Group, owns ten solar power plants in Southern Ukraine with an installed capacity of 267 MW.

Chinese companies tried to participate in public procurement tenders in Ukraine, quite successfully in 2018 when Dongfang Electric International Corporation (DEIC) won a contract to reconstruct Unit 6 of Slovianska thermal power plant for $684 million.

However, Chinese participation in public tender activity slowed down in 2019 and 2020 due to malpractices. Chinese companies used to offer very attractive terms, but after winning a contract, tried to win time, increase price, and change some other terms. Later, procurement terms were adapted to address such a trick.

The Belt and Road Initiative is a strategy for the international trade expansion proposed by China, covering Asia, Africa, and Europe. Within the strategy, in Ukraine, the dredging of the Pivdenny port in the Odesa region was completed, which amounted to $40 million.

In September 2019, the concept of the multimodal China-Ukraine-EU High-Speed Highways project was presented. Since June 2020, the container train from Wuhan runs weekly.

From June 2021, a train from Guangzhou to the DP World TIS Pivdennyi sea terminal, which carries household and electrical goods from China, started running regularly. Using Chinese contractors and workers to carry out projects reduces the positive impact on the local economy.

First regular container train brings Ukrainian exports to China

Read also:

- Ukraine’s China policy: A (not so) delicate balance

- Flirting with China is a dangerous political game for Ukraine

- Ukraine drops support for Uyghur declaration: Beijing’s pressure or Kyiv’s foreign policy shift?

- China on the map of information warfare: Russia’s disciple and “big brother”

- Exploiting the crisis in Afghanistan: Russian and Chinese media draw parallels with Ukraine and Taiwan