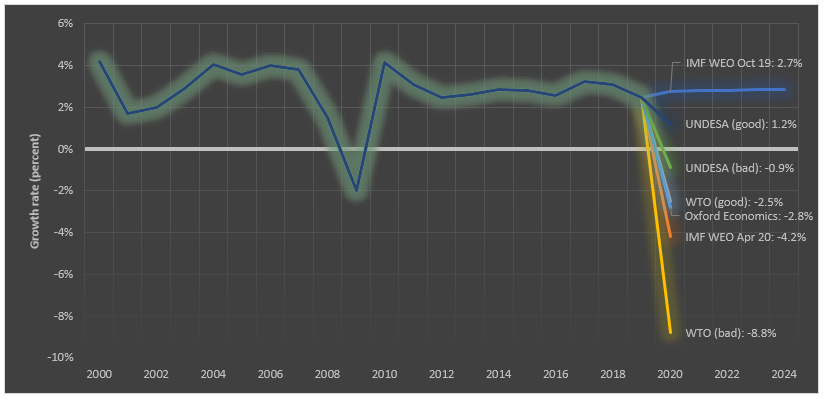

In 2020, 93% of countries have entered and will remain in recession. As a comparison, during the Great Depression in 1931, only 84% of countries were in recession, while the 2009 economic crisis affected a mere 61%. The World Bank names the current crisis “the deepest global recession in decades”, and it indeed may be so when taking into account that the 2009 crisis resulted in only 2% contraction in global GDP. The IMF estimates the impact of the current crisis at 4.2% of global GDP decline until the end of 2020.

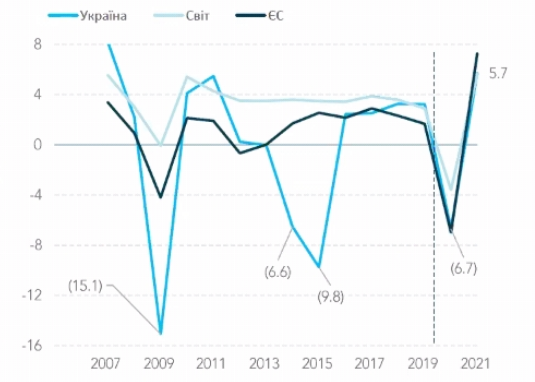

According to the Ukrainian government, OECD analysis and the investment advisory board Investment Capital Ukraine (ICU), Ukrainian GDP may contract by around 7% in 2020. That is nearly the same as the extent of contraction as projected for the EU as a whole. Although still very bad, this data means that in contrast to the EU and the world (which will lose more due to the current crisis than in 2009) Ukraine will not suffer to the same degree as in 2009 (15%), and 2014-15 due to Russian aggression (16%). Here is some more data that reveals how heavily lockdown will hit the world economy in general and Ukraine in particular.

Industrial decline in Ukraine even more dramatic than in the world

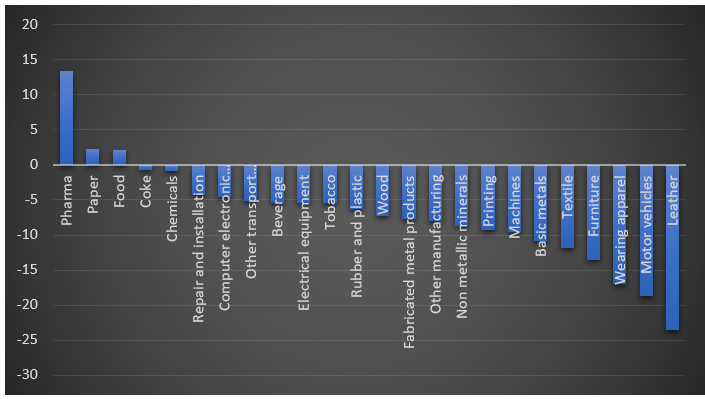

Falling industrial production worsened by the Corona lockdown has been a worldwide economic trend during recent months. The production of all types of products, except for pharma, paper, and food, has declined.

However, in Ukraine, the decline in industrial production is particularly hard. Already setting in during the summer of 2019, it accelerated at the end of 2019 and especially during the current lockdown. The contraction contributed to the record low Ukrainian GDP growth in the last quarter of 2019 since 2016, and it is the main reason behind the decline in Ukrainian GDP this year.

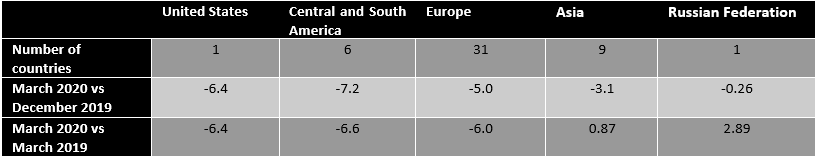

As shown in the table below, the Index of Industrial Production dropped by 6.4% in the US, 6% in Europe in March 2020 compared to March 2019. Asia however remains more stable. As for Ukraine, the same index lost 7.7% in March and a shocking 16.2% in April 2020 compared to March and April 2019 respectively. Over the first four months of 2020, industrial production in Ukraine fell by 7.9% compared to the same period last year. Production of steel and finished metal products declined the most, as the GMK Center reports.

While the Ukrainian economy is driven by services that constitute about 65% of GDP, the decline of industrial facilities and total dependence on foreign supply of even primitive goods is in no way a good trend. At the very least, it is leading to growing unemployment amongst those workers who are not ready to adjust to the IT sector or other services but are no longer called upon to work in factories. The already high pre-lockdown unemployment rate of 8% in Ukraine is projected to increase to 10-14% in 2020 according to various estimations. The number of officially registered unemployed in Ukraine has already risen by 60% to 500,000 during the lockdown.

The good news: UAH exchange rate, central bank foreign currency reserves, and other macroeconomic indicators may even strengthen amid coronavirus

Despite the general decrease in Ukrainian GDP, the other macroeconomic indicators such as UAH exchange rate and foreign exchange reserves will remain unchanged, Oleksandr Martynenko, an analyst for ICU, claims. In particular, he says that lockdown measures such as the closure of transport, restaurants, and cafés mainly mean the decline in internal consumption and salaries. That also results in a sharp decline in Ukraine’s imports. However, Ukraine’s export will suffer less due to the large share of food and services in the export — spheres less affected by the lockdown. Low prices for oil and gas that are imported by Ukraine also contribute to lower imports.

Overall, the 2020 figure for Ukraine’s imports is projected to decrease by 23%, with exports only falling by 13%. Therefore, the trade deficit will decrease by 71%, Oleksandr Martynenko says, meaning considerably less foreign currency will leave the country.

Also, the capital outflow from Ukraine will be small in 2020 ($2bn) in comparison to 2014-2015 when the war with Russia started and $15bn of capital was withdrawn from Ukraine. This current $2bn outflow will be well compensated by the inflow in 2021, an analyst at ICU says.

Recent agreement with the IMF - the key tool to mitigating Ukraine’s foreign debt servicing that reaches a peak in 2020; risk of default minimized

In 2020, Ukraine should pay the highest sum for servicing its foreign debt in comparison with 2018-2019 or 2021 and thereafter. These $6.2 billion constitute about 15% of Ukrainian state budget and in the context of coronavirus lockdown could mean default. Yet the recently agreed $2.1 billion IMF loan and €1.2 billion loan from the EU represent tremendous international support for the country. Ukraine and the IMF reached a new agreement in June 2020 after the long procedure of adoption of the law launching the Ukrainian land market as well as the law prohibiting the return of nationalized bankrupt banks to their former owners (so-called anti-Kolomoyskyi law).

- Read also: Moratorium on land sales no more: how Ukraine’s land market will operate with the new law

While general Ukrainian state debt may increase from 51% to 57% of GDP in 2020 to cover the enormous budget deficit caused by coronavirus, this will still be below the EU recommended benchmark of 60%, ICU analysts said at their press conference.

Also, the lowest key policy rate in Ukrainian history established at 6% by Ukraine’s Central Bank on 12 June this year sets good preconditions for cheap loans and economic recovery. This, however, should be supported by general tax, judiciary, and other institutional reforms that are currently on hold.

Read more:

- 10 successes of Ukraine in 2019 you don’t know about but should

- Ukraine’s economic losses due to Russian occupation of Donbas

- 84% of Ukrainians believe in populist economic fairy tales

- Punishment or well-designed institutions: what will eliminate corruption in Ukraine?

- Why can’t Ukraine just get rid of its oligarchs?